Competitive Mortgage Rates and Fees in Arizona, California, Colorado, Florida, Idaho, Ohio and Texas

Bonelli Financial Group blends human expertise with the power of artificial intelligence to deliver a seamless and personalized mortgage lending experience.

Save Time

Getting Loans in Arizona, California, Colorado, Florida, Idaho, Ohio and Texas

At Bonelli Financial Group, we combine the insight of experienced mortgage professionals with cutting-edge artificial intelligence to deliver a modern, streamlined mortgage experience. Whether you're purchasing a new home or refinancing an existing loan, our goal is simple: to help you secure lower mortgage rates and reduced refinance fees in Arizona, California, Colorado, Florida, Idaho, Ohio, and Texas.

How Bonelli Financial Group Can Help You Lock in Lower Mortgage Rates

Our team of licensed and highly experienced mortgage loan officers is committed to guiding you through a fast, efficient, and stress-free loan process. We understand that navigating the mortgage landscape can be overwhelming. That’s why we’ve reimagined the process to make it easier, faster, and more transparent, so you can focus on enjoying your home—not worrying about paperwork.

We offer access to some of the most competitive mortgage home loan options on the market, tailored to meet a wide range of financial situations. Whether you’re a first-time homebuyer or a seasoned investor, we’ll help you secure favorable loan terms that align with your current and future financial goals.

Competitive Rates

We compare loan options from multiple lenders to help you secure competitive rates and terms.

Save Money

Unlike banks we don't have high fees and hidden costs. Total Transparency.

Save Time

We are known for fast approval & closing times to make the mortgage loan process smooth.

Home Loans

Debt Service Coverage Ratio (DSCR) Loans

LEARN MOREFederal Housing Authority (FHA) Loans

LEARN MOREHome Equity Loans (HELOANs)

LEARN MOREHome Equity Lines of Credit (HELOCs)

LEARN MORETexas 50(a)(6) Loans

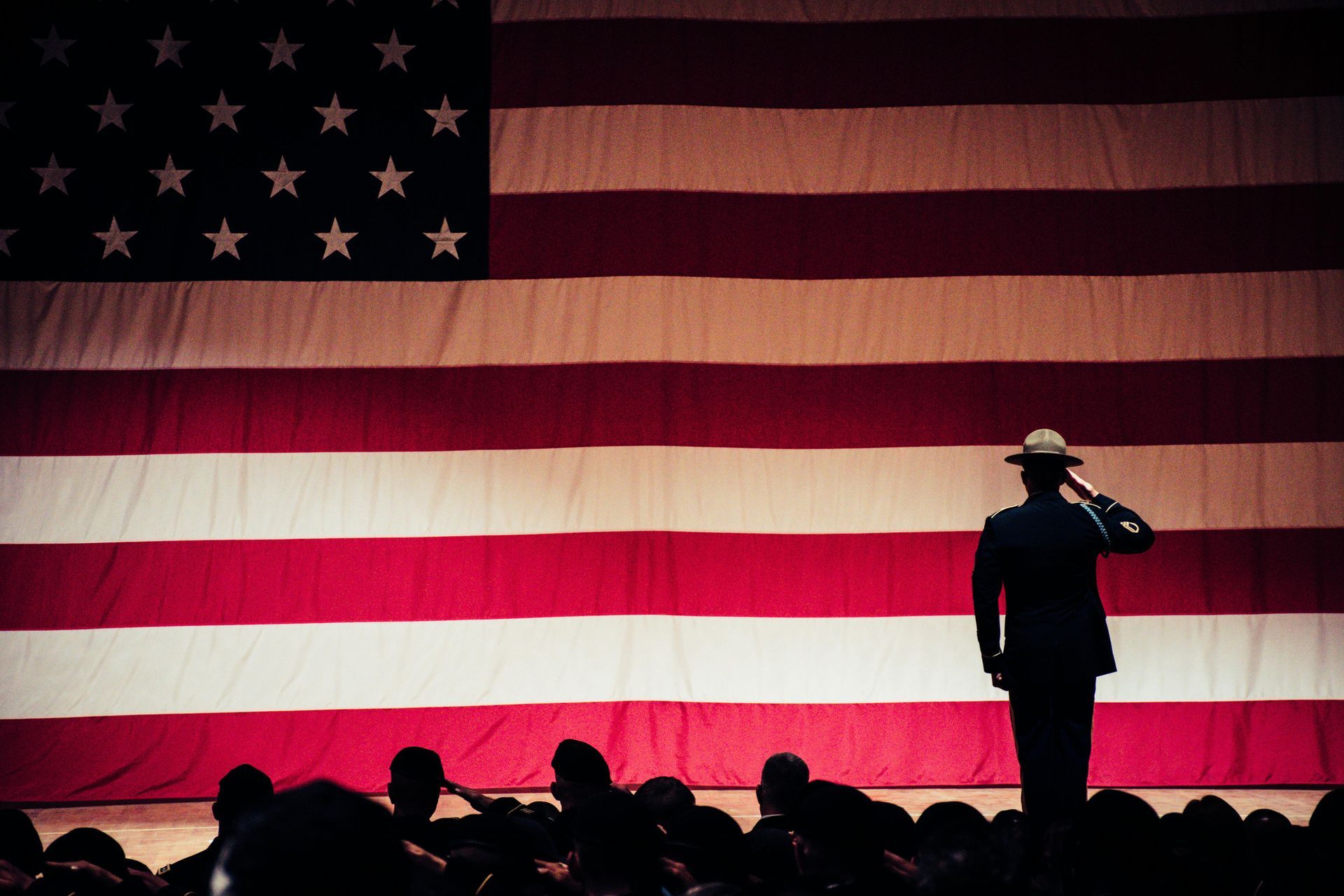

LEARN MOREVeteran Affairs (VA) Loans

LEARN MOREHOPER | FHA Energy Efficiency Program

LEARN MOREAbout Bonelli Financial Group

Bonelli Financial Group specializes in delivering customized mortgage solutions for homebuyers and homeowners. Our process starts with a detailed financial consultation, allowing us to match you with the best mortgage rates and loan terms that suit your unique financial goals. From first-time buyers to seasoned homeowners, our mission is to make mortgage lending smarter, simpler, and more rewarding.

We shop your loan to multiple lenders to ensure you get the best possible rate & terms.

Offering Competitive Mortgage Rates and Reduced Refinance Fees

Refinancing your mortgage can be a smart move—especially when you work with a lender that offers low refinance costs and flexible loan terms. At Bonelli Financial Group, we make refinancing easy and beneficial by helping homeowners reduce their monthly payments, access lower interest rates, adjust the length of their loan, or tap into home equity. Our mortgage experts work one-on-one with clients to ensure you understand your options and choose a refinancing strategy that supports long-term financial success.

Choosing the right mortgage lender makes a significant difference. Bonelli Financial Group stands out for exceptional customer service, transparent pricing and no hidden fees, and access to a wide range of home loan products. With Bonelli FG, you get the peace of mind that comes from working with a trusted partner who’s focused on your financial future. Whether you're purchasing a home or exploring refinance options, we’re here to help. Contact Bonelli Financial Group today at 800-266-3554

to schedule a free consultation and discover how we can help you.

Bonelli Financial Group Stands Apart from the Typical Mortgage Industry Lenders

Personal Approach

We believe that the mortgage process should be more than just a transaction — it should be a partnership. Unlike big lenders that treat you like a number, we take the time to understand your unique needs and financial goals. Our team provides a tailored, one-on-one experience, guiding you through each step of the process with clarity and care

Competitive Pricing

Without the heavy corporate structure and overhead costs of larger lenders, Bonelli Financial Group can offer competitive pricing that directly benefits you. By operating efficiently, we can offer cost savings that translate into competitive rates and minimized fees for you.

Balanced Use of AI

We embrace AI to streamline and speed up the loan approval process, making it smooth and efficient. However, we never rely solely on technology. Our team is always just a phone call away, ensuring you receive the personal attention and care that every mortgage experience deserves.

Customer Reviews

50

YEARS COMBINED EXPERIENCE

1000+

SATISFIED CUSTOMERS

7

AVAILABLE LOAN OFFICERS

1000+

DEALS SECURED

Latest Lending and Mortgage Blog

Describe some quality or feature of the company. Write a short paragraph about it and choose an appropriate icon.