Competitive Mortgage Rates and Fees in Idaho

Bonelli Financial Group blends human expertise with the power of artificial intelligence to deliver a seamless and personalized Idaho mortgage lending experience.

How Bonelli Financial Group Can Help You Lock in Lower Idaho Mortgage Rates

We Have a Team of Licensed and Experienced Idaho Mortgage Loan Officers. Whether you're looking to buy a home in Idaho or refinance your existing Idaho mortgage loan , borrowers often dread the mortgage loan and refinance process. That is because the traditional way to shop for a mortgage loan is antiquated and broken. Bonelli Financial Group has a streamlined the mortgage loan process to be easy, fast, and exciting so you can focus on enjoying your new home and this new chapter in life without the stress of a long and complicated mortgage loan process.

Competitive Rates

We compare loan options from multiple lenders to help you secure competitive rates and terms.

Save Money

Unlike banks we don't have high fees and hidden costs. Total Transparency.

Save Time

We are known for fast approval & closing times to make the mortgage loan process smooth.

When searching for mortgage home loans in Colorado, it is crucial to consider reputable CO home lenders like Bonelli FG who offer competitive rates and lower refinance fees. Bonelli FG lenders are recognized for offering competitive mortgage home loans in CO with flexible terms to suit a variety of financial situations.

Finding the right lender can significantly impact the overall cost of your mortgage and your ability to refinance in the future. Refinancing your mortgage can be smart, especially if you can secure lower refinance fees from an ID home lender. Refinancing allows homeowners to adjust their loan terms, reducing monthly payments or changing the loan duration to better fit their current financial goals.

By partnering with an ID home lender that offers lower refinance fees, you can maximize your savings and improve your financial flexibility. It is essential to thoroughly research and compare different ID home lenders to ensure you get the best mortgage home loans in Idaho. Look for lenders with a strong reputation for customer service, transparent pricing, and a wide range of ID home loans. This will help you find a mortgage that meets your needs while providing the most favorable terms.

With careful consideration and thorough research, you can find an ID home lender that not only meets your immediate needs but also supports your long-term financial goals, providing you with a sense of security and reassurance about your financial future. Call

Bonelli Financial Group at

800-266-3554.

Idaho Home Loans

Debt Service Coverage Ratio (DSCR) Loans

LEARN MOREFederal Housing Authority (FHA) Loans

LEARN MOREHome Equity Loans (HELOANs)

LEARN MOREHome Equity Lines of Credit (HELOCs)

LEARN MORETexas 50(a)(6) Loans

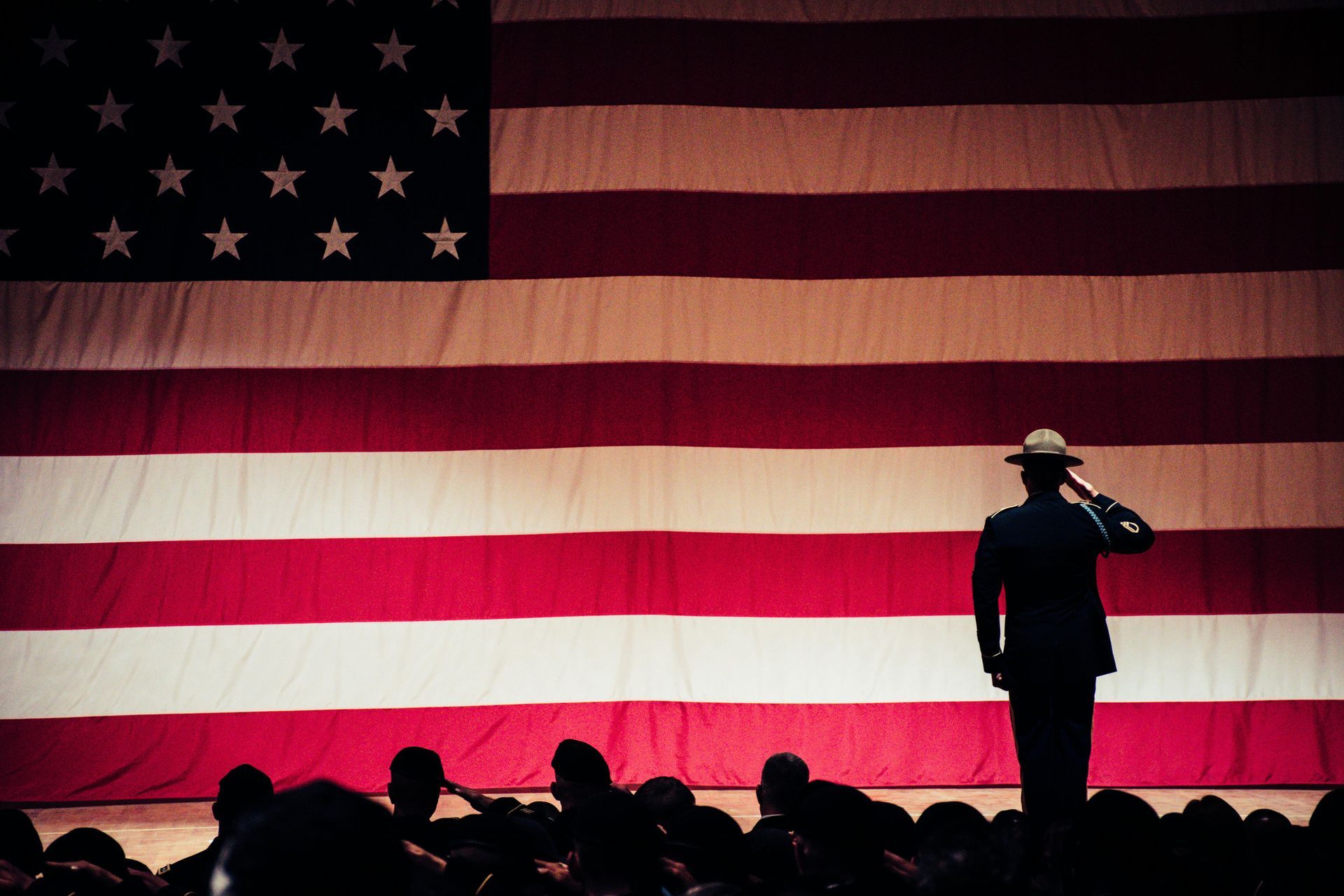

LEARN MOREVeteran Affairs (VA) Loans

LEARN MOREAbout Bonelli Financial Group in Idaho

Bonelli Financial Group specializes in delivering customized mortgage solutions for Idaho homebuyers and homeowners. Our process starts with a detailed financial consultation, allowing us to match you with competitive mortgage rates and loan terms that suit your unique financial goals. From first-time buyers to seasoned homeowners, our mission is to make Idaho mortgage lending smarter, simpler, and more rewarding.

Personal Approach

We believe that the mortgage process should be more than just a transaction — it should be a partnership. Unlike big lenders that treat you like a number, we take the time to understand your unique needs and financial goals. Our team provides a tailored, one-on-one experience, guiding you through each step of the process with clarity and care

Competitive Pricing

Without the heavy corporate structure and overhead costs of larger lenders, Bonelli Financial Group can offer competitive pricing that directly benefits you. By operating efficiently, we can offer cost savings that translate into competitive rates and minimized fees for you.

Balanced Use of AI

We embrace AI to streamline and speed up the loan approval process, making it smooth and efficient. However, we never rely solely on technology. Our team is always just a phone call away, ensuring you receive the personal attention and care that every mortgage experience deserves.

Customer Reviews

The Idaho housing market continues to show signs of resilience heading into the end of 2025. While mortgage rates remain elevated compared to the record lows of previous years, the pace of price growth has stabilized, and inventory levels are slowly improving across the state.

Mortgage Rate Outlook

As of late 2025, Idaho’s 30-year fixed mortgage rate generally ranges between 6.25% and 7.1%, depending on borrower credit, down payments, and lender programs. The 15-year fixed rate typically falls between 5.75% and 6.5%.

Most analysts expect rates to stay in this general range for the remainder of the year, with a possible gradual decline if inflation continues to ease. Even small drops in rates could have a meaningful impact — for example, a 1% decrease on a $400,000 loan can reduce monthly payments by roughly $250.

Key Market Trends and Statistics

Home Prices:

The median listing price in the Boise metro area is around

$585,000, reflecting a modest increase of about 4–5% from last year. Across the state, prices are stabilizing, with many markets seeing slower growth but continued demand for well-located and updated homes.

Inventory Levels:

Home inventory has improved slightly statewide, increasing by about

10–15% compared to last year. However, supply still lags behind pre-pandemic norms, especially in Ada, Canyon, and Kootenai counties. New construction is helping fill the gap, though build times and costs remain factors.

Affordability:

Affordability remains a challenge, particularly for first-time buyers. Elevated mortgage rates and steady prices mean many households must adjust expectations on size or location. Some buyers are exploring adjustable-rate mortgages or looking farther from urban centers for better value.

Regional Shifts:

Suburban and rural demand continues to rise as families seek more space, newer construction, and quieter neighborhoods. Towns surrounding Boise, Twin Falls, and Coeur d’Alene are experiencing increased buyer activity as remote and hybrid work lifestyles persist.

Population and Growth:

Idaho remains one of the nation’s faster-growing states by population. In-migration from higher-cost areas is sustaining housing demand and contributing to continued competition for desirable listings. This population growth supports property values but adds pressure to already limited supply.

Market Conditions to Watch

- Competitive Listings: Well-priced homes in desirable areas continue to draw multiple offers, particularly in the $400K–$600K range.

- Moderate Price Growth: Expect annual appreciation around 4–6% statewide, with Boise and Meridian potentially at the higher end of that range.

- Improving Inventory: While more homes are hitting the market, buyers still face limited options compared to long-term averages.

- Steady Demand: Lifestyle buyers and relocations from neighboring states remain key market drivers.

What It Means for Buyers and Sellers

For Buyers:

Patience and preparation are key. Getting pre-approved early, monitoring rate trends, and being ready to act when the right home appears can make a significant difference. Even in a higher-rate environment, competition remains strong for quality listings.

For Sellers:

Conditions remain favorable for those pricing realistically. Homes in move-in condition or with recent updates tend to sell quickly, especially in high-demand neighborhoods. With inventory still below average, sellers retain an advantage heading into 2026.

*The mortgage rate data, housing forecasts, and lending information provided are for informational purposes only and reflect estimates and publicly available reports as of early 2025. Sources such as Bankrate.com, KBOI, Fannie Mae, JVM Lending, and Realtor.com are cited for reference, but their projections are not guarantees of future outcomes. Mortgage rates, home prices, and loan limits may vary based on individual circumstances, location, and lender policies. Please consult a licensed mortgage or real estate professional for personalized guidance and the most current information.

50

YEARS COMBINED EXPERIENCE

1000+

SATISFIED CUSTOMERS

7

AVAILABLE LOAN OFFICERS

1000+

DEALS SECURED

Latest Lending and Mortgage Blog

Describe some quality or feature of the company. Write a short paragraph about it and choose an appropriate icon.